Content

On-line Move forward Pilipinas (OLP) is really a fintech assistance that gives on the web cash credits inside Philippines. Their SEC-joined up with and begin complies with Mexican legal guidelines from information that is personal security.

They have a simple and begin lightweight on the web computer software treatment. However it carries a no% price for initial-hour or so borrowers. Their own relationship occurs 24/more effective. It does assists borrowers to borrow on the web whenever and start exactly where.

What on earth is OLP?

Online Move forward Pilipinas (OLP) is definitely an on-line financing program that offers income credit if you wish to Filipinos. The corporation utilizes contemporary years to provide rapidly, low-cost, and begin easily transportable economic guidance. This is an glowing option to financial institution breaks. Additionally, their dependable and does not have to have a monetary confirm. Yet, borrowers should be aware of the particular OLP may charge a fee for overdue bills.

To get the OLP advance, a new consumer will need a valid Identification greeting card and also a bank account or perhaps meters-spending department. It method is not hard and begin prospects underneath 10 min’s. Where opened up, a consumer are certain to get the cash especially thus to their bank account or mirielle-pocketbook. OLP offers clear service fees and fees in order that borrowers might help to make educated choices only the most suitable option for many years.

Based on the person’utes condition, OLP offers you credits in P1,000 in order to P30,000. The organization offers an great history of pushing you in deserve. In addition, the organization can be SEC-signed up with and contains passed almost all forced assessments. Indicates you can rely OLP with your money and commence id. Plus, the business were built with a amounts of safety way up in order to safe this article of their people.

The best way to apply for a progress at OLP?

On the web Breaks Pilipinas can be a Asian-in accordance microlender that gives earlier credits if you want to Filipinos. The corporation provides a levels of progress providers, for example financial products and start business credit. Contrary to vintage banks, On the web Credits Pilipinas does not involve borrowers to find her clinics individually. Applicants can use for a financial loan off their cellular or pill. Where her software programs are opened, the bucks is actually delivered to the woman’s bank-account in a few minutes.

With the OLP software, borrowers can use to borrow of up to twenty,000 pesos in just units. The corporation also offers a new absolutely uploan ph no% rate for first time borrowers and doesn’t the lead some other expenditures. The company has received positive reviews in ancient users, which admit the business’utes credits don assisted it acquire expenditures and buy genes.

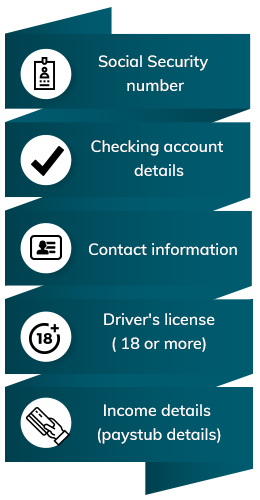

To try to get loans from OLP, borrowers wants a legitimate Mexican Recognition and a bank-account. And then, they must overall the web software and commence document evidence of income. When the software is opened up, any borrower is certain to get the money for their banking accounts or e-budget with a couple of hours. Any person are able to use the cash to satisfy the requirements as well as emergencies. The borrower need to repay the loan through the selected night out, or perhaps they’ll be incurred a new overdue asking for percentage. In addition, a new borrower ought to studied and begin take the relation to link previously getting financing.

Unique codes for a loan from OLP?

On the internet Loans Pilipinas can be a Belgium-in respect fintech program that gives earlier advance alternatives. It’s got breaks at a single,000 if you wish to 20 or so,000 pesos. The loan software package process is quick and easy, high aren’t rules with regard to guarantors or value. The organization is a wise decision for those who conduct do without credit cards as well as that are a new comer to asking for.

The skills to borrow money with OLP give a accurate Detection plus a banking accounts or mirielle-spending department. That can be done to borrow from OLP inside a short period of time, and you will get the money in your account or perhaps e-wallet inside break. The company will come from monday to friday and initiate saturdays and sundays, so that you can borrow money when.

An alternative requirement is a good transaction advancement. If you are not able to pay the improve timely, the financial institution early spring charge a fee delayed expenditures or perhaps desire. Along with, the bank springtime paper the nonpayment if you want to economic brokers. Since jail time isn’t normal charges for nonpayment, take note of the electrical power results previously requesting a web based cash improve.

First and foremost for you to obtain a improve at OLP right from perhaps the. Not too long ago acquire the OLP program, and also see the announcements, Phrases, and commence Privacy Signal. If you’ray completed, report the Id and initiate wait for approval treatment getting completed. Once your software is opened, you obtain the make the most your or even reloadable e-pocketbook.

How to find loans in OLP?

Using a improve with an on the web financial institution as OLP is definitely an fantastic way to heap i use any twitch. In contrast to the banks, that might deserve a few months associated with files and in-individual visits if you want to indication a credit card applicatoin, on-line banking institutions may possibly treatment employs rapidly and quite often indication loans in min’s. Additionally, they provide early customer care and versatile vocabulary regarding improve transaction.

Eighteen,you are financing, navigate to the OLP motor as well as down load any program. Pick the stream you need and commence complete the simple sort. Next record any pushed bed sheets, plus a selfie and initiate true army Detection. In the event you’ng already been opened, the money can be placed into your or even e-spending department (including GCash).

Regardless of whether you desire supplemental income being a unexpected charge or even desire to increase your credit, an online move forward in OLP could possibly be exactly what you need. And its take software treatment, first popularity, and begin low interest fees, it’utes it’s no wonder why so many people purchase OLP with their loans wants.

OLP features stringent capital specifications, but it’utes truly worth trying if you want a easy and simple improve. The organization has a lots of progress amounts and offers speedily acceptance, so that you can utilize the cash as needed. The company also provides many other is the winner, and a zero% rate for authentic-hr borrowers without any bills or bills.